Toygaroo Net Worth reflects a fascinating story of innovation, ambition, and downfall in the startup world. Launched as the “Netflix for Toys,” Toygaroo introduced a fresh toy rental business concept that quickly attracted attention after appearing on Shark Tank. The idea promised affordable access to premium toys through a smart subscription-based model, appealing to parents across the United States.

Despite strong investor interest and early popularity, Toygaroo faced rising operational costs and poor financial management that led to its closure. Its journey from promise to business collapse remains one of the most discussed failed startups, offering valuable lessons for entrepreneurs and investors alike.

Who Founded Toygaroo?

The team behind Toygaroo included entrepreneurs who believed in changing how children interact with their toys. The entrepreneur’s journey began with idea-generation around toy circulation rather than ownership. One of the founders had prior experience in software and e-commerce, while others came from marketing and retail backgrounds.

They envisioned a toy-sharing concept that would align with modern habits—switching rather than hoarding toys. Their brand aimed to make toy ownership optional, tapping into sustainable values and parental convenience.

YOU CAN ALSO READ THIS:Helen Labdon Net Worth 2025 – Wealth, Income, and Lifestyle Revealed

The Unique Business Model of Toygaroo

Toygaroo operated via a service where parents subscribed, selected a number of toys each month, and then received them by mail. When a toy was returned, another one from the list shipped out. This toy delivery system mirrored streaming services: constant novelty, minimal upfront purchase.

This rental service for kids was designed to reduce costs for families and clutter in the home. The company marketed the convenience of a rotating toy catalogue rather than static ownership. But the business operation model required tight cost controls in warehousing, cleaning, and shipping, which the business struggled to maintain.

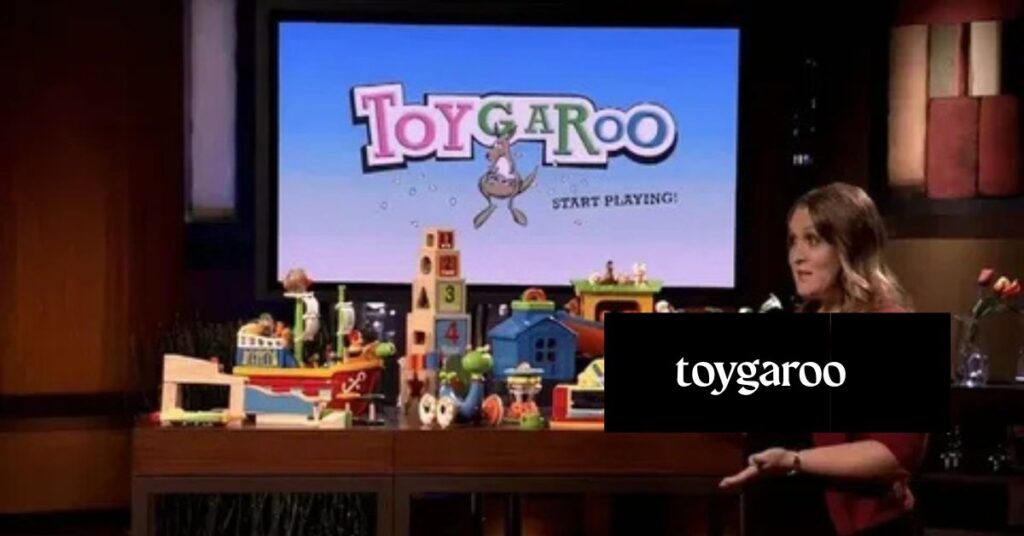

Toygaroo Shark Tank Pitch

In its appearance on the business TV programme, Toygaroo pitched for a deal, showing its growth plan and target market. The presentation highlighted how the average American household spends over a thousand dollars a year on kids’ toys, while their services could cost a fraction. During the run-time of the show, the business pitch generated major attention.

The founders faced tough questions about scalability and cost margins. Concerns about the subscription-based model and high variable costs were raised, showing that novelty alone isn’t enough for sustainable success.

Which Sharks Invested in Toygaroo?

The deal struck involved two prominent investors from the show: one known for harsh negotiating, the other for tech and media acumen. The Mark Cuban deal, together with the Kevin O’Leary investment, gave Toygaroo its financial push. They secured funds and strategic advice from seasoned startup investors aiming for a meaningful investment return.

The investors’ expectations were high: they wanted rapid growth and market dominance in the toy rental niche. The founders accepted the terms, hoping to scale fast, but the pressure to expand quickly would later be pivotal.

Toygaroo Valuation During Shark Tank

When the deal was done, Toygaroo business valuation was pegged at around one million dollars based on the ask and equity offered. The founders argued that the service could disrupt the children’s toy subscriptions space and had a first-mover advantage. The exposure boosted its brand popularity after the show, adding to perceived value.

Yet the company valuation decline started soon after the peak. As expenses rose and growth slowed, the once promising numbers lost shine. A deeper financial history analysis reveals the mismatch between ambition and capital.

What Happened to Toygaroo After Shark Tank?

Following the televised segment, the company experienced a wave of new sign-ups thanks to the attention. These sudden gains exposed vulnerabilities in inventory provisioning and cost control. Post-Shark Tank updates highlight how the model exploded in demand before the infrastructure was ready.

The business faced mounting post-investment struggles as toy sourcing proved costlier than anticipated. The business growth challenges multiplied when each delayed return or damaged toy raised replacement costs.

Why Did Toygaroo Fail?

A mix of high shipping bills, unpredictable inventory wear and tear, and a promise of free return postage triggered a cascade of issues. Business failure reasons included variable toy sizes, lack of wholesale deals, and an unsustainable product return policy.

With the consumer demand drop after initial hype and mounting startup cash flow issues, the model collapsed. The story serves as a serious caution: even good ideas suffer when financial mismanagement and scaling missteps align.

Toygaroo Bankruptcy and Closure Details

The company filed for Chapter 7 liquidation within a few years of the investment. When it went bankrupt, all operations ceased, and assets were liquidated. The company’s bankruptcy meant that both investors and subscribers were left with sunk value.

The investor reaction ranged from regret to reflection: some chalked the loss up to lessons learned in the subscription economy. The tale is now used as a frequent failed business example in startup circles.

Toygaroo Founder’s Net Worth After the Company’s Collapse

Following the shutdown, the founder’s exit story was less about fortune and more about pivot. The entrepreneurs moved on to new ventures, sometimes in unrelated fields, showing entrepreneurial resilience. Estimating how much the founders earned is difficult, but public records suggest a limited financial windfall from that project.

The impact on founders’ careers was significant: many gained experience but little wealth. The investor’s current net worth remains unaffected in the big picture, but the brand owns a place in the annals of failed startups.

How Much Was Toygaroo Worth at Its Peak?

At its zenith, Toygaroo had a business valuation of around one million dollars during the show, and revenue estimates reached nearly one million in its first full year of operations. The table below gives an approximation of its key financial statistics.

| Year | Estimated Revenue | Notable Event |

| 2010 | $150,000 | Launch of service |

| 2011 | ~$1,000,000 | Hit after TV exposure |

| 2012 | $0 | Service wind-down, bankruptcy filings |

These numbers highlight company revenue issues: rapid expansion followed by sudden collapse. The business valuation plunged as toy wear and shipping costs stacked up beyond margins.

Lessons Entrepreneurs Can Learn from Toygaroo Failure

The Toygaroo saga offers rich lessons for entrepreneurs: validate cost structures early, test shipping models, and avoid scaling before stabilising operations. The lessons from failed startups remind owners to monitor management decisions and anticipate surprise costs.

A strong idea isn’t enough when business sustainability issues aren’t addressed. The case appears often in startup schools as a failure analysis of how good concepts fail due to overlooked operational fundamentals.

Comparison: Toygaroo vs Modern Toy Subscription Services

Modern services like KiwiCo and Lovevery succeeded by refining logistics, crafting tangible value, and setting realistic subscription pricing plans. In contrast, Toygaroo aimed fast but lacked optimization of its business operation model for scale. Many competitors in toy rental learnt from Toygaroo’s mistakes and built robust frameworks around inventory turnover and cleaning.

Today’s models combine toy curation, educational value, and efficient shipping in a way Toygaroo could not. They turn the toy rental idea into a sustainable venture while avoiding the traps of mass-scale expansion before foundation.

Where Are the Toygaroo Founders Now?

Some of the founders shifted to other startups or consultancies, while others left public view entirely. Many share the tale of Toygaroo as a turning point in their career, a reflection of market signals and market response. Their brand now exists mostly as a learning point.

The business legacy after closure lives on in classes and entrepreneurship rounds. The story is not about a financial win but about what happens when ambition outpaces execution. The startup ecosystem effects include stronger caution among investors and founders alike.

Conclusion

The story of Toygaroo net worth isn’t about how much money the business made—it’s about what remains when the balance sheet hits zero. This venture became an emblem of the pitfalls waiting behind fast-moving ideas in the toy subscription model space.

Although the company ended in loss, its legacy provides business lessons learned for innovators ready to launch the next big thing.

FAQ’s

Is Toygaroo still in business?

.

No, Toygaroo is no longer in business and shut down after facing financial struggles.

Is Toygaroo successful?

No, Toygaroo was not successful and became a notable failed startup.

Who is the owner of Toygaroo?

The owner and founder of Toygaroo is Tara and Anthony (founding team).

How much did Toygaroo cost?

Toygaroo estimated valuation at its peak was around $1 million during Shark Tank.

Who got the biggest offer in Shark Tank history, $30 million?

The biggest offer of $30 million was made to Madi and Mackenzie McGraw for their company Lumio.

Who invested in Toygaroo?

Mark Cuban and Kevin O’Leary invested in Toygaroo on Shark Tank.

Who was the girl who turned down a $30,000,000 Shark Tank deal?

Madi McGraw turned down a $30 million Shark Tank deal for her company Lumio.

What did Mark Cuban sell for 5.7 billion?

Mark Cuban sold Broadcast.com to Yahoo for $5.7 billion in 1999.

What is the #1 product in Shark Tank history?

The #1 product in Shark Tank history is Scrub Daddy, the smiley-faced sponge.